4 Ways Level Funded Health Plans Help Manage Costs for Employers

Why Level Funding?

How Does It Work?

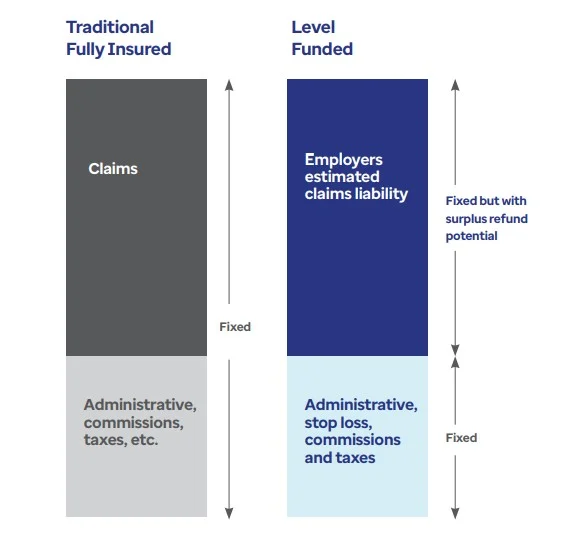

Level funded plans are designed to offer employer predictability with the potential for upfront savings and a surplus refund.

What’s driving the increased adoption of these plans? As health care costs continue to rise and broader economic uncertainty persists, employers are seeking more cost-effective plan designs. Enter level funding:

Level funded plans may reduce costs by passing savings to the employer unlike fully insured plans, where any savings remain with the insurer. With level funding, employers as plan sponsors may earn a potential surplus refund for their health plan that can be applied to the following year’s plan.

As a result, these plans may cost employers less than fully insured plans. In fact, employers may pay an average of 21% less with Level Funded plans compared to fully insured plans.

Level funded plans continue to gain traction in the health care marketplace. In fact, 42% of small firms in 2024 reported having a level funded plan, compared to just 7% in 2019, according to the Kaiser Family Foundation Employer Health Benefits Survey.

Level funded plans offer transparency that many fully insured, small group plans can’t provide. While plan designs and coverages are very similar to fully insured plans, level funded plans are much more competitively priced.

Understanding level funded plans

While there’s been increased adoption of level funded plans, experts find that there’s confusion about how they work. This is understandable, given the complexity around how they’re funded and their regulatory requirements. However, at their core, level funded plans are generally self-funded plans with 3 key differences. (though certain plan components may vary based on the carrier):

- Stop loss insurance to help mitigate claims risk

- An opportunity for a surplus refund

- A third-party claims administration agreement

Level funded allows us to be more agile and able to react quicker to changes and the needs of the market. As a type of self-funded health plan, level funded plans are built to provide the pricing stability employers want and need, and provide them an opportunity for a surplus refund.

Level funded plans can also include monthly reports with data that employers can use to track health care usage, as well as wellness programs that may increase plan participant engagement and reduce costs.

To take a closer look at how level funded health plans help manage costs for employers, here’s how they compare to self-funded and fully insured plans:

Strategically-Crafted Benefit Plans

1. Level funded plans offer predictability and mitigate the risks of self-funded plans

Similar to a self-funded plan, level funding allows employers as plan sponsors to assume the financial risk of providing health services to employees by directly paying for plan participant medical claims. How do these plans mitigate risk? Employers with level funded plans pay a fixed monthly fee, which covers the maximum claims liability, administrative fees and stop loss insurance to protect against unexpectedly high claims costs and utilization. In a self-funded model, the employer pays more if claims costs are higher than anticipated and gets money back if claims costs are lower at the end of the plan year. Level funded plans, however, cover the cost of individual or aggregate claims that exceed the plan’s maximum, while offering the employer an opportunity to receive money back if lower-than-expected claims produce a surplus.

Level funded plans mitigate risk associated with the self-funded model. There is no risk of additional liability outside of what is being funded.

2. The plan sponsor may receive a surplus refund with level funded plans

With a fully insured plan, the insurance company assumes the financial risk for providing health services to the employer group. For a fixed cost paid by the employer, the insurer pays covered health care claims costs and covers administrative costs, sales commissions and taxes. At the end of the plan year, if the actual medical and pharmacy claims costs are higher than expected, the insurer pays them. The insurer keeps the difference if they’re lower. In contrast, an employer with a level funded plan is insured against higher-than-expected claims costs while potentially receiving a surplus refund resulting from lower-than-expected claims costs.

For employers, there’s an incentive to help keep their employee populations healthier to drive for a greater surplus refund.

Note: If you would like to upload a census for a free quote. You can use your own census template, so long as it includes the required fields. Or, you can download our census form directly here. Please upload your census via the design request submission page and we’ll get back to you in 5-7 business days!

3. Level funded plans offer greater insights to help manage costs

Employers with level funding can receive detailed monthly data reports to help them better understand employee utilization of health services and manage their benefits, which isn’t the case with most fully insured plans.

With monthly reporting package, employers are able to see how their group is running and they can see trends and utilization within their specific population. The report contains a lot of impactful and useful information.

They don’t have to wait until the renewal period at the end of the year before understanding how member behavior may be driving up costs.

These insights may enable employers to alert individual members that:

- Low-cost generic medications can often be substituted for brand name medications

- Going to urgent care may be more appropriate and less costly than going to the emergency room

- Seeing their primary care provider virtually rather than in person can save them time and money

Detailed data reports are a huge advantage, especially for small employers, by giving them insights into their virtual care usage, ER use, pharmacy utilization and network strategy.

Tracking these things over time and making informed decisions as needed can help drive a better employee experience.

4. Employee experience is key within the level funded model

Level Funded plans include wellness programs and 24/7 virtual care options, which may help employees and their families play a more active role in their health care and save on out-of-pocket costs. Employees in some areas may be invited to participate in Rewards Programs, where they can earn up to $1,000 for completing healthy activities. To offer employees more convenience, 24/7 virtual care is available for a variety of conditions, including general medical care and behavioral health counseling.

The employee experience including virtual, health engagement and plan design options is what distinguishes the level funded plan from fully funded.

It helps to increase engagement for employees;

for employers, it’s the opportunity to lower costs and the chance to achieve a surplus refund.

Please don’t hesitate to contact us here.

"Helping Businesses Build Better Benefits. Helping Employees Build Better Retirements. RIA in Buckhead. Benefit Planning. Wealth Management. Wills. Trusts. Estate Planning."